Why Cyber Insurance is Pushing Small Businesses to Partner with Cybersecurity MSPs

In today’s digital landscape, cyber liability and breach insurance have become essential for businesses seeking protection against financial losses from cyberattacks and data breaches. However, obtaining and maintaining these policies is increasingly challenging due to evolving cyber threats and stringent insurer requirements. This environment drives small businesses to partner with Managed Service Providers (MSPs) specializing in cybersecurity.

The Rising Challenge of Cyber Insurance Claims

A recent report highlights a concerning trend: over 40% of cyber insurance claims were denied in 2024. (Source) This statistic underscores the difficulties businesses face in meeting insurers’ rigorous standards.

Key Reasons for Claim Denials:

- Failure to Meet Security Requirements: Insurers now mandate robust cybersecurity measures, including multi-factor authentication (MFA), endpoint detection, and least privilege access. Businesses lacking these protocols risk claim denial.

- Policy Exclusions: Certain policies exclude specific attack types, such as those resulting from employee negligence or unapproved third-party vendors. Incidents falling into these categories may not be covered.

- Inadequate Documentation: Insurers require comprehensive records demonstrating adherence to best practices before and after an attack. Insufficient documentation can lead to claim rejection.

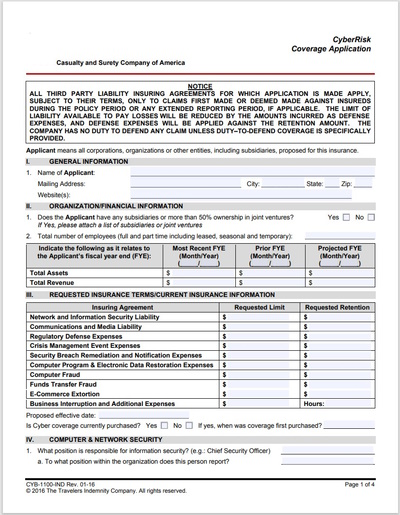

- Misrepresentation on Applications: Providing inaccurate or incomplete information during the application process can result in claim denial due to misrepresentation.

- Delayed Reporting: Policies often require immediate incident notification. Delays can lead to automatic denial.

The Role of MSPs in Navigating Cyber Insurance

Partnering with an MSP specializing in cybersecurity offers several advantages:

- Cybersecurity Expertise: MSPs possess the knowledge to implement and maintain robust cybersecurity measures, ensuring businesses meet insurer requirements.

- Accurate Application Assistance: MSPs can guide businesses in accurately completing complex cyber liability insurance applications, reducing the risk of misrepresentation.

- Comprehensive Documentation: MSPs help maintain detailed records necessary to prove adherence to best practices, essential for supporting potential claims.

- Proactive Security Measures: MSPs adopt a proactive approach, focusing on preventing cyberattacks and data breaches, thereby reducing the likelihood of filing a claim.

- Reputation Management: In the event of a cyber incident, MSPs assist in managing the business’s reputation, minimizing damage and maintaining customer trust.

Conclusion

As cyber threats continue to evolve, the complexities of obtaining and maintaining cyber liability and breach insurance increase. By partnering with MSPs specializing in cybersecurity, small businesses can enhance their security posture, ensure compliance with insurer requirements, and reduce the risk of claim denials. This collaboration not only safeguards financial interests but also helps maintain operational integrity and reputation in an increasingly digital world.